- Since I realized that there are many foreign investors who are interested in Japanese company who are conducting Bitcoin Strategy such as MSTR in USA, I decided to make English version of this article

- Most of the content in this article is based on previous Japanese article. I translated in English(70% using google translate!) and added some supplementary comments

- Hope this information will be a help to understand Metaplanet's capital policy for all the investors in the world!

- Notes: This article is not intended to solicit specific stocks. Please make investments at your own risk.

Comments as of 28 November 2024 when ATM offering was announced

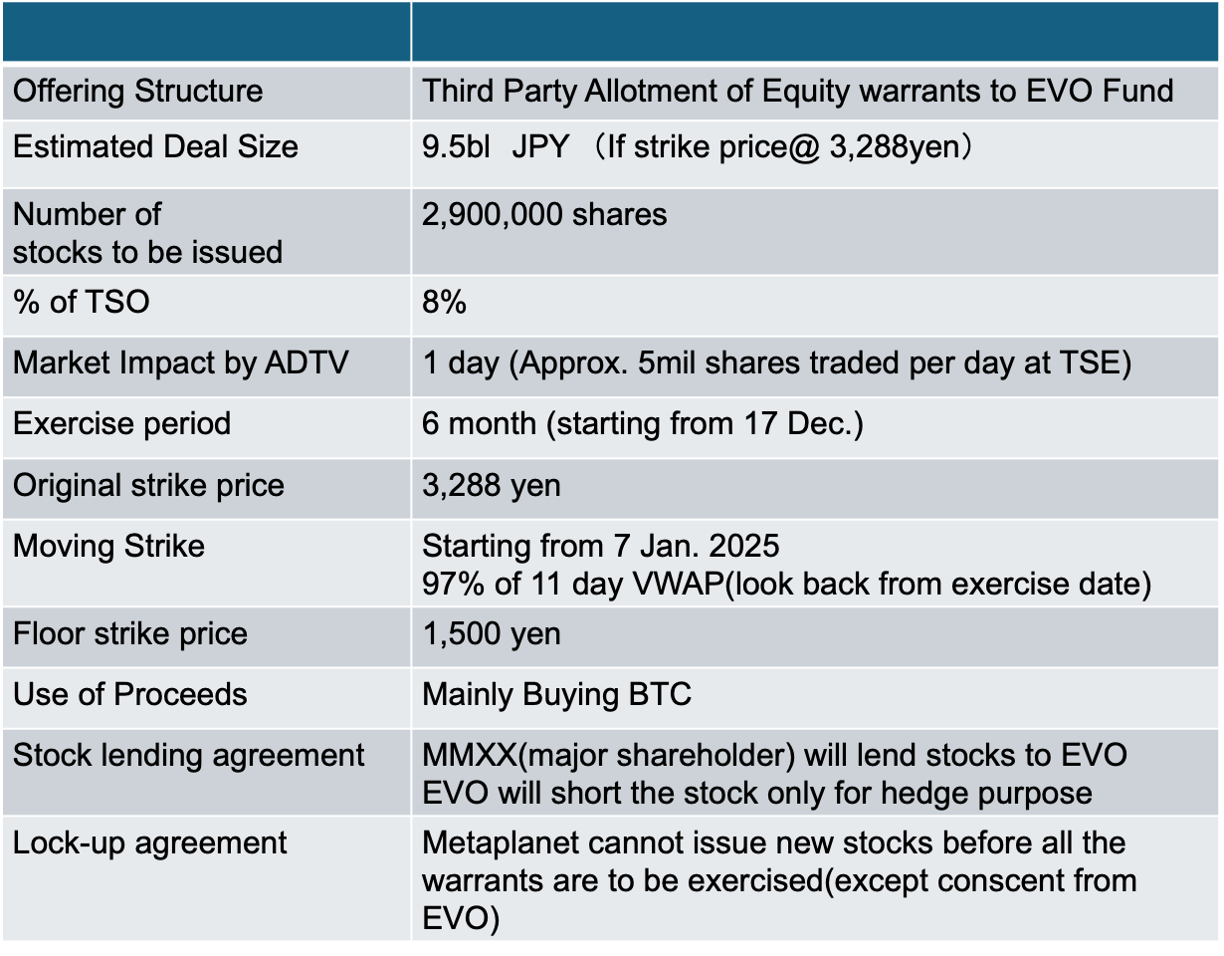

This is a Japanese version of ATM offerings: Not typical MS warrants implemented by companies with weak financial bases

- MS(Moving Strike) warrants have a negative image in Japan, but this case is different. I think it should be considered as the Japanese version of the At The Market Offering common in the United States.

- In Japan, MS warrants are often issued by companies whose BS is weak. In such cases, the moving strike price is generally set at a discount of 8-10% from the market price. In reality, the terms are often set favorably for the allottee because those issuers have no other choice

- On the other hand, the discount for this transaction is extremely tight. It's only 3%. The level of discount is similar to that of ATM offerings in the United States.

- Gross-discount(Cost) of PO by typical Japanese company's is usually 7% in total(consisting of a 3% discount to the investors and a 4% underwriting fee to the underwriters)

- ATM fees in the United States are said to be 1-3% (ATM offering fees in MSTR case was 2%)

- So, from Metaplanet point of view, 3% discount is the most effective way to raise capital in Japan.

- Why using warrants to conduct ATM? It is just a legal issue(Japanes corporate law) In Japan, to make same effect as ATM offering, company have to use warrants

Given the current liquidity situation, exercise could be completed within 1-2 weeks.

- The actual amount of funds raised will depend on future stock price movements.

- Currently, the daily trading volume is 5 million shares

- If the current trading volume is maintained, it will be possible to sell 500,000 shares per day even with a 10% participation rate

- The exercise period is six months according to the terms of issue, but if all goes well, I think the exercise will be completed within one or two weeks.

The 2.9 million shares limit is thought to be due to regulations on third-party allocations (25% rule)

- This time, 2.9 million shares, or 8% of the shares issued, seems like an odd number, but I believe there is a reason for this.

- The Company has allocated warrants (worth 4.91 million shares) to Evo in October 2024.

- Generally, when implementing a third-party allotment that exceeds 25%(within 6 months) of TSO, approval procedures at the general shareholders meeting or an independent third-party committee are required.

- Considering the 25% rule, Metaplanet decided to issue warrants worth 2.9 million shares. This was an upper limit to avoid exceeding 25%

Although a lock-up has been granted, additional equity financing is expected after the exercise is completed.

- The company plans to hold an extraordinary shareholders' meeting in December 2024 to expand its authorized shareholder quota.

- The current number of issued shares is 36.33 million, with 65 million authorized.

- In fact, the rights offering carried out in August cannot be reissued due to a lack of authorized shares (36.33 million shares x 2 > 65 million shares).

- The company plans to expand this to 145 million shares, meaning it will be able to conduct another rights offering from next year onwards.

- Metaplanet use BTC yield as a KPI. Their basic strategy is to increase the amount of Bitcoin they hold, so additional capital funding is essential.(Same strategy as MSTR)

Why was the initial exercise price set high?(40% premium from announcement date) ? →To enjoy tax benefits

- The exercise price of the warrants is set at 3,288 yen until January 7, 2025, which is higher than the market price and makes it difficult to exercise them in 2024.

- The reason is that it is a measure to enjoy tax benefits (it is rare for a company to honestly state in its disclosure documents that it is a tax measure).

- Specifically, if the company's capital exceeds 100 million yen by the end of the year, it will be treated as a large corporation under the tax system and will no longer be able to enjoy tax benefits.

- The company's capital has increased to 5.7 billion yen due to a rights offering in 2024, but it plans to hold an extraordinary general meeting of shareholders later this year (December 13, 2024) and reduce the capital to 1 yen.

- If the warrants issued this time are exercised and the capital exceeds 100 million yen by the end of the year, tax merits will disappear

- It seems that the company doesn't expect the stock price to exceed 3,288 yen by the end of the year.

Comments as of 20 Dec. 2024 after announcement of completing 9.5 Billion Yen raised by this transaction

- As described in the previous section, warrants were resolved to be issued on November 28, 2024, and were to be exercised on December 17, at the earliest, but they have already been exercised in full.

- I would like to explain how the full exercise of the shares was achieved and how well-thought-out the product design was

Since the exercise price was set high for 2024, it was expected that exercise would begin the following year.

- The initial exercise price of the warrants was set at 3,288 yen, a 40% premium over the closing price on the day of issue (2,333 yen).

- As an ordinary person, I thought the following at that time (I never imagined that it would exceed 3,288 yen by the end of the year):

- Due to tax considerations, the option is not expected to be exercised within the year, but is designed to be exercised from January 7th of next year

- The 11th business day prior to 1/7, when the exercise price adjustment begins, is 17 Dec. (corresponding to the exercise start date).

- In other words, if you short sell about 500-10 billion yen every business day from December 17th, and exercise the warrants for the number of short shares you have accumulated on January 7th, you will be able to raise funds and purchase BTC from the beginning of the new year.

- The discount rate of the shares issued at that time is a 3% discount from the average VWAP. This is a more favorable condition than the discount rate of regular MS warrants (8-10%). This is the Japanese version of an ATM offering!

- Why was it announced on November 28th when it will start from the new year? (Isn't that too early?)

- In this regard, I think it is related to the fact that an extraordinary general meeting of shareholders will be held on December 13th. At the general meeting of shareholders, there will undoubtedly be a flood of questions related to equity finance in the future. If you do not disclose it in advance, you will not be able to give a detailed answer

- I guess they thought it would be inappropriate from the perspective of accountability to shareholders to disclose the warrant issuance right after the shareholders meeting.

Surprise #1: The stock price exceeds 3,288 yen, meaning the options can be exercised within the year!

- I was underestimating the BTC/Metaplanet market. I never imagined that the stock price would rise more than 40% in just two weeks.

- So, being an ordinary person, I thought the following:

- Since the exercise price (3,288 yen) has been exceeded, EVO will likely begin short selling (in fact, as of December 13th, short selling equivalent to 1.456 million shares has been completed).

- If the shorted shares are exercised on January 6th of the new year, the difference between the average short selling price and 3,288 yen will be EVO's profit.

- I realized one important point here.

- Why was the exercise price adjustment start date set to 1/7 instead of 1/6, the first day of the new year?

- This was to allow them to short sell in advance if the stock price exceeded 3,288 yen by the end of the year, and exercise the warrants at 6 Jan., the first business day of the new year, in order to raise funds as quickly as possible while enjoying tax benefits!

- Do you normally design warrants with that in mind? (In my previous job, I designed warrants and CBs and originated them for clients, so when I realized this, I was so excited that my brain juices started flowing.)

- As a result, EVO is expected to exercise 2.9 million shares at 6 Jan. This will bring in 9.5 billion yen in funds for Metaplanet in mid-January, and they will be able to buy BTC in mid-January (this warrant was a great success!).

Surprise #2: Using corporate bonds to buy BTC before the end of the year!

- As of December 13th, EVO reported its short selling amount, so the surprise (#1) was predictable, but a further surprise occurred on December 17th.

- Metaplanet announced that it would issue corporate bonds worth up to 9.5 billion yen to EVO, the warrant holder.

- The main features of the bonds are as follows:

- The planned issuance amount (maximum) is 9.5 billion yen (equivalent to 2.9 million shares x 3,288 yen).

- The interest rate is zero

- The maturity date is June 2025, but EVO can redeemed it at any time.

- EVO is scheduled to pay the warrant exercise amount(9.5 billion yen) on January 6th of the new year.

- Therefore, if EVO pays the 9.5 billion yen in advance in the form of corporate bonds by the end of the year, Metaplanet will have the full amount of cash before the exercise is completed. This will enable them to purchase BTC by the end of 2024.

- For MetaPlanet, maximizing BTC yields before FY2024 is the most important KPI. So, buying BTC before the end of the year is significant.

- From EVO's perspective, 9.5 billion yen worth of warrants have already been short-sold and profits have been confirmed. The settlement is scheduled at January 6th of the new year, but it was brought forward at the request of the issuing company (if the bonds are redeemed early at the same time as the warrant exercise fee is received, the actual counterparty risk will be around two weeks).

Conclusion:

- There were two big surprises in this financing. They will purchase 9.5 billion yen worth of BTC by the end of the year while taking tax measures. This is something that an ordinary person would never have imagined on November 28th, but the issuer and EVO had anticipated this and designed this financing (I'm impressed).